In What Footnote Can Investors Read About the Company's Intangible Assets on the 10k

What are Fiscal Statement Notes?

Financial statement notes are the supplemental notes that are included with the published financial statements of a visitor. The notes are used to explain the assumptions used to ready the numbers in the financial statements, as well as the accounting policies adopted by the company. They help different types of users, such as financial analysts and investors, to interpret all the numbers added to the fiscal statements.

When conducting an audit of the fiscal statements, the auditor conducts a thorough investigation of all the information independent in the financial statements, including the notes to the fiscal statements. Auditors use the notes to determine if the accounting policies used are appropriate, properly practical, and are reflected in the reported results of the company.

The notes may too provide data on underlying issues relating to the overall fiscal health of the company. The auditor bases his audit opinion on the fiscal statement numbers, also equally the notes to the financial statements.

Summary

- Financial statement notes refer to the additional notes included in the financial statements of a visitor,

- The notes are used to make important disclosures that explain the assumptions used to prepare the financial statements of a company.

- Common notes to the financial statements include accounting policies, depreciation of assets, inventory valuation, subsequent events, etc.

Common Notes to the Financial Statements

The post-obit are the mutual items that appear in the notes to the financial statements:

1. Footing of presentation

The outset section in the financial argument notes explains the basis of preparing and presenting the cardinal fiscal statements.

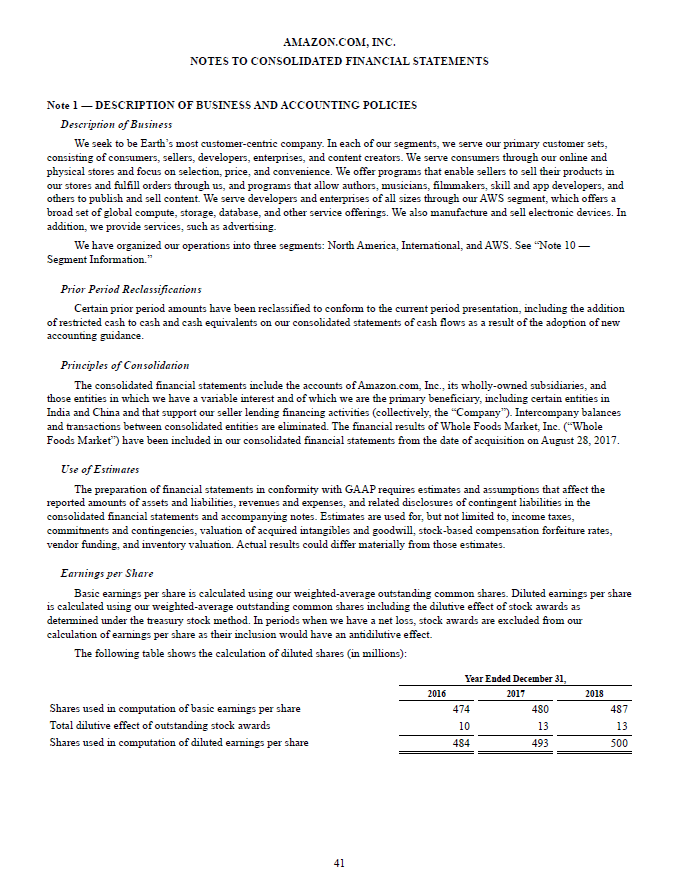

2. Accounting policies

The accounting policies section provides information on the accounting policies adopted by management in preparing the financial statements. Disclosing the bookkeeping policies helps users translate and understand the financial statements amend.

Some of the disclosures included here are the depreciation method used, how the company values inventory, accounting for intangibles , etc. All the pregnant accounting policies adopted in the financial statements must exist disclosed in the department.

3. Depreciation of assets

Depreciation refers to the reduction in the value of a fixed asset over time due to normal wear and tear. The asset depreciation department provides information on the method adopted past the company when depreciating the assets.

Depending on the depreciation method used, there may exist significant fluctuations between the net income in the income statement and the value reported in the balance canvas. Providing data on the depreciation method in the notes informs the users of the differences in net incomes reported in the financial statements.

4. Valuation of inventory

The valuation of inventory annotation informs users how the company valued its inventory, making it piece of cake for them to compare inventory figures from one period to another or vis-à-vis other competing entities. The department provides information on two master inventory issues, i.e., how inventory amount is stated and the method used to determine inventory cost.

GAAP rules crave companies to country their inventory lower of cost or market (LCM) . Information technology means that the company volition value the inventory at the everyman replacement cost, which tin can be either the wholesale cost of inventory or the toll of the inventory in the market. To determine inventory cost, GAAP allows 3 different methods, which include the weighted boilerplate, specific identification, and the first-in, commencement-out (FIFO) method.

five. Subsequent events

Information on any subsequent events can be found as well in the fiscal statement notes department. Subsequent events refer to events that occur later on the balance sheet date but earlier the release of the financial statements. How the company handles the events depends on whether they change the conditions in existence as of the balance sheet date.

The two types of subsequent events are:

Additional data: An event that provides information on conditions in existence equally of the balance canvas date, including additional information that affects estimates used to prepare the financial statements. An example would be a business concern combination after the remainder sheet date.

New events: An event that provides new information about weather that did non exist as of the balance sheet engagement. An example would be the damage or theft of a machine in a factory.

Generally accepted bookkeeping principles state that fiscal statements should include the effects of all subsequent events that provide additional information about atmospheric condition in beingness as of the balance sheet date. Subsequent events that are new events, nevertheless, should not be reflected in the financial statements, but if textile, must exist disclosed in the notes to the financial statements.

vi. Intangible assets

The notes to the financial statement likewise include information on whatsoever intangible avails endemic by the visitor. Intangibles are assets that have no physical form, and they include trademarks and patents. The section details all the intangible avails that the company owns and how it adamant the value of intangibles reported on the balance canvas.

7. Consolidation of financial statements

The consolidation of the financial statements section confirms that the statements being issued contain financial statements of all of the subsidiaries of the company and how information technology accounts for them. It details the basis of consolidating the fiscal statements, and any deviations from the subsidiaries should be explained.

8. Employee benefits

The employee benefits section of the notes mentions the benefits that the company provides to its employees, including health insurance, health savings accounts, retirement plans, etc.

Typical data that a visitor discloses in the notes includes the health and welfare plans for its employees, such as the medical, holiday, fringe benefits. It also provides information about the paid and unpaid expenses and liabilities for employee retirement plans .

9. Contingent liability

A contingent liability refers to liability that may occur, but it depends on the issue of an uncertain future issue. An instance of a contingent liability is an outstanding lawsuit against the company or an income tax dispute . Disclosing the contingent liabilities informs users that the company may incur a loss in the future if the impending event ends upwardly against the company's favor.

Boosted Resources

Thank you for reading CFI's guide to Fiscal Statement Notes. In order to help you become a world-class financial annotator and advance your career to your fullest potential, these additional resources volition exist very helpful:

- Analysis of Financial Statements

- Forensic Audit Guide

- Depreciation Methods

- IFRS vs. United states GAAP

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/financial-statement-notes/

0 Response to "In What Footnote Can Investors Read About the Company's Intangible Assets on the 10k"

Post a Comment